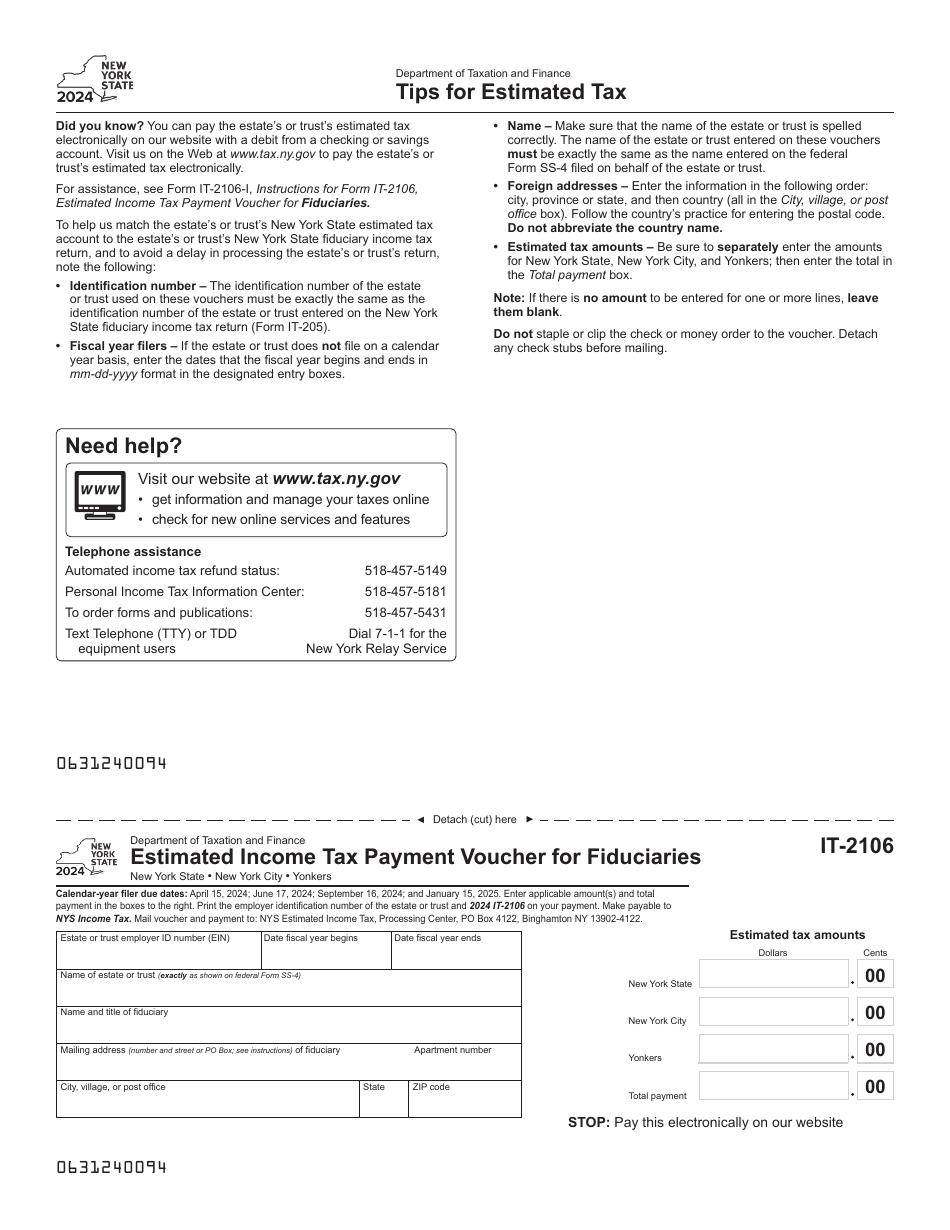

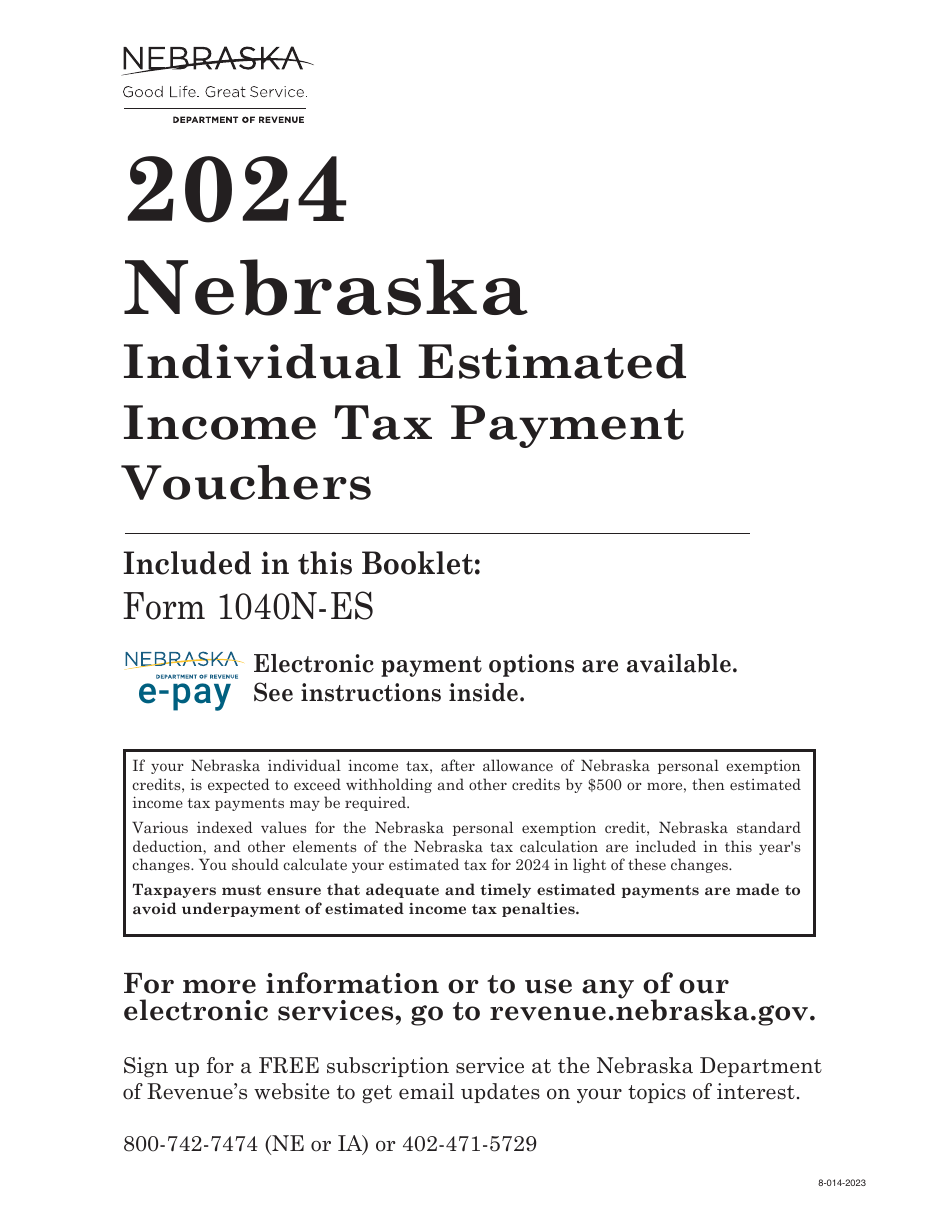

Nys Estimated Tax Payments 2024 Schedule. Estimated income tax due dates. Corporations with an estimated tax liability of over $1,000 must make quarterly estimated tax payments as well.

Due dates that fall on a weekend or a legal. Quarterly estimated ptet payments for tax year 2023 are due march 15, june 15, september 15, and december 15, 2023.

Nys Estimated Tax Payments 2024 Schedule Images References :

Source: beckiycandida.pages.dev

Source: beckiycandida.pages.dev

Nys Estimated Tax Payments 2024 India Britte Nickie, While cannabis suppliers won a victory when the state replaced the potency tax with a flat tax, and the change from quarterly to annual tax payments helped, there.

Source: nelldarline.pages.dev

Source: nelldarline.pages.dev

Nys Estimated Tax Payments 2024 Form Kylie Kaylee, The final quarterly payment is due january 2025.

Source: zarayolenka.pages.dev

Source: zarayolenka.pages.dev

2024 Va Disability Payment Schedule Pdf Download Glad Philis, In 2024, estimated tax payments are due april 15, june 17, and sept.

Source: nanceyenriqueta.pages.dev

Source: nanceyenriqueta.pages.dev

Estimated Tax Payments 2024 Safe Harbor Inez Reggie, Estimated income tax due dates for tax year 2024 are as follows:

Source: ibbyqelfrieda.pages.dev

Source: ibbyqelfrieda.pages.dev

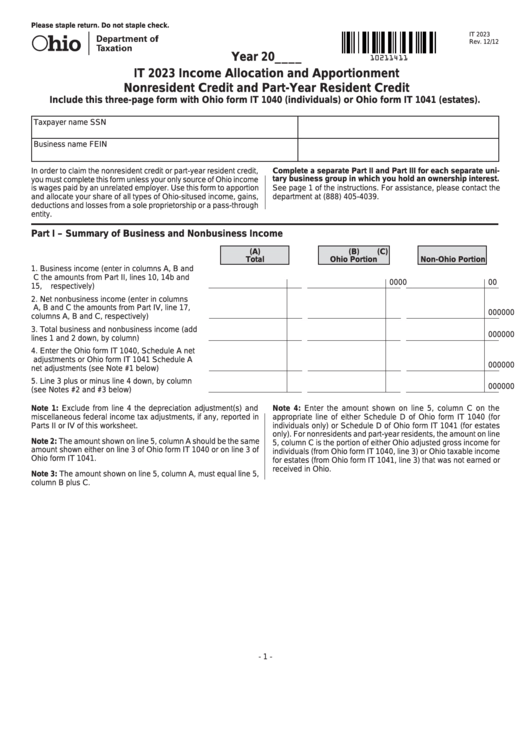

Nys Estimated Tax Calculator 2024 Willi Odilia, How do i show that the taxpayer made prepayments to ny and/or nyc?

Source: faricaymelisent.pages.dev

Source: faricaymelisent.pages.dev

Pa State Estimated Tax Payments 2024 Pdf Ivonne Maureen, New york state and new york city estimated tax payments due for q4 (prior year).

Source: npifund.com

Source: npifund.com

Quarterly Tax Calculator Calculate Estimated Taxes (2024), When are estimated tax payments due in 2024?

Source: annoraylarina.pages.dev

Source: annoraylarina.pages.dev

Nys Estimated Tax Payments 2024 Online Aubrey Stephie, Corporations with an estimated tax liability of over $1,000 must make quarterly estimated tax payments as well.

Source: vannybgilberte.pages.dev

Source: vannybgilberte.pages.dev

Estimated Tax Payments 2024 Schedule Pdf Cami Marnie, Federal quarterly estimated tax 4th installment (fourth quarter 2023).

Source: mandyymelisenda.pages.dev

Source: mandyymelisenda.pages.dev

Nys Estimated Tax Payments 2024 Randy Marice, New york state requires taxpayers to make estimated payments if $300 or more in new york state, new york city, and/or yonkers tax is expected to be owed after.

Category: 2024